Data has become the sexiest word in the recruitment market across industries. Finance is no exception. From fund managers to investment bankers, there is a skills shortage among trained analytics talent, according to John DelSanto, senior managing director for Accenture’s Financial Services group in North America.

“Finding and accessing analytics talent will require innovative sourcing strategies to bridge the gap between supply and demand,” he says.

Accenture, the global management consultancy firm, has joined Stevens Institute of Technology, a private research university, to address the gaping hole. Other financial groups, including hedge fund AQR Capital, have similar deals with top business schools.

Stevens has rolled out a Financial Services Analytics (FSA) graduate certificate program, which combines academic thinking with industry experience to address evolving analytics needs in finance, such as data visualization and big data.

It is part of a broader deal between the two institutions that includes advanced analytics research projects and workshop sessions with Accenture’s financial services clients.

The tie-up illustrates the way consultancy firms are looking to business schools for analytics talent, as Stevens’ students will have the opportunity to participate in internships with Accenture and other leading firms.

Accenture will also fund scholarships for two students each year to cover tuition and costs.

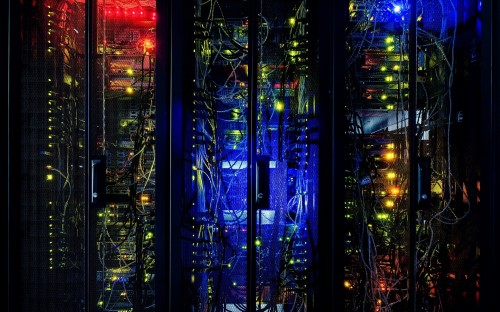

The major vendors of the financial services application market – which includes analytics, alongside risk and compliance and IT – are big tech groups such as IBM, Infosys, Oracle and SAP.

This industry will be worth more than $103 billion by 2019, according to data from MarketsandMarkets, a market research firm.

Banks, which face the twin hurdles of greater regulatory pressure and public distrust for their role in the global financial crisis, are looking to innovative solutions to navigate a tougher regulatory regime.

Aidan Brennan, KPMG’s global head of management, says: “Financial services clients want to draw breath but probably won’t be able to do that for long – the need for real change in banking and insurance is huge.”

Banks including Goldman Sachs and Bank of New York Mellon have invested in big data and other digital areas, as Wall Street begins to tap into financial analytics.

For the finance industry, the demand for professionals with credentials in financial services analytics is strong, and it is growing at a rapid pace, according to Accenture.

Recent research from the consultancy found that one of the main challenges organizations are facing globally to unlock the potential of big data is the lack of talent to implement and run data and analytics solutions on an ongoing basis.

An Accenture report – “The Looming Global Analytics Talent Mismatch in Banking” – revealed that the US could face a shortage of more than 260,000 analysts by 2015.

It articulated specific strategies for closing the talent gap, including the addition of business analytics coursework in higher education.

Dinesh Verma, dean of the School of Systems and Enterprises at Stevens, says that an ability to understand and analyse data to allow for strategic insights will be a “key competitive discriminator for all organizations – commercial, government and academic”.

Business managers must now be tech savvy and business schools are pushing the data surge in their classrooms.

McMaster University’s DeGroote School of Business recently launched an EMBA degree focused on big data and strategy with IBM and CIBC, Canada’s fifth largest chartered bank by deposits.

Brian O’Donnell, chief data officer at CIBC, says that the banks’ goal is to help develop a new crop of digitally-literate financial services managers.

He adds: “Creating leaders that have the ability to translate data into strategy, ideas and actual solutions that benefit clients, will be an even more important asset for companies like CIBC in the future.”

A number of top business schools run financial analytics specializations within their MBA programs, which look at areas such as data mining and fixed income asset pricing.

These include the Analytic Finance concentration within the MBA at Chicago’s Booth School of Business, and the Financial Systems and Analytics track at NYU’s Stern School of Business, both in the US.

And New York’s Lally School of Management & Technology offers a masters degree in Quantitative Finance and Risk Analytics.

In the UK, Swansea University runs a dedicated MSc Business Analytics and Finance degree, along with the University of Southampton which offers an MSc Business Analytics and Finance program.

Others have general business analytics degrees which draw financial services managers. London’s Imperial College Business School recently launched an MSc in Business Analytics, after receiving £20 million in funding from professional services firm KPMG to establish an analytics research centre in the UK.

Australia’s Melbourne Business School began teaching a Master of Business Analytics course this year, in response to the urgent need among businesses for well-trained analytics professionals, according to Jennifer George, program director.

“Most executives are aware of this but are also conscious that they and their organizations are on a steep learning curve. This is fuelling a lot of interest in business analytics,” she says.

Jennifer Whitten, director of career services for the W.P Carey School of Business at Arizona State University, which runs a Masters in Business Analytics, says there is increasing demand for business students with analytical skills.

She adds: “They are all looking for talent that has the technical and business savvy to understand, interpret and effectively communicate how data can drive decision-making.”

Student Reviews

Imperial Business School

RECAPTHA :

21

38

b6

a2