Top MBA applicants show diligence in selecting business programs as an investment in their future. Accordingly, MBA applicants are thinking critically about the recent news reports that claim there is a decrease interest in US MBA programs due to the US political landscape.

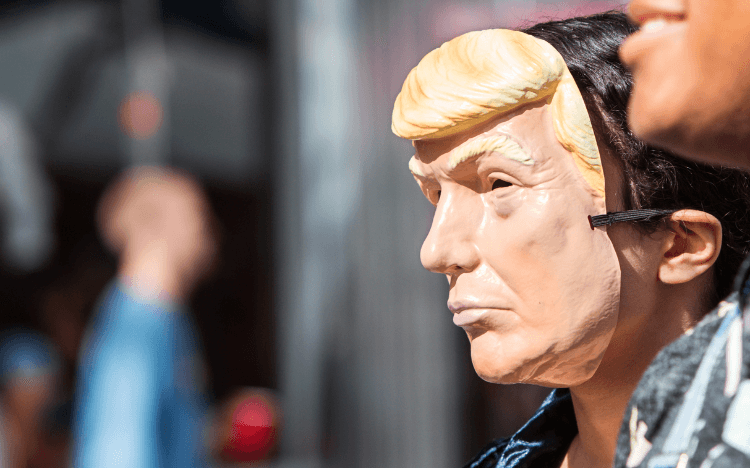

Is the US political climate (or the ‘Trump effect’) driving changes for the top MBA programs?

A new study, conducted by Stacy Blackman Consulting (SBC), measures reactions to Donald Trump’s political and economic policies from MBA candidates directly, for the first time. The survey results were aggregated from responses across current season MBA candidates, with over 500 respondents spanning the globe; 46% US citizens and 54% internationals.

Finding: The widely-reported Trump effect—and its impact on US MBA demand—is overstated. Further, the Trump effect is not influential for applicants who favor the top-ranked US MBA programs, such as Harvard, Stanford and Wharton. (See infographic below)

Within this article, we present four key assumptions that top MBA candidates should evaluate.

Assumption 1: Graduate management programs are the same as MBA programs.

False: Graduate management programs are not the same as MBA programs. The recent media reports of falling US business school demand invoke the recent 2018 GMAC study, which included graduate management programs of all types: Masters in Accounting, Masters in Management, PhD programs, post graduate diplomas, and online MBA programs.

Of the total programs included in the GMAC study, only 25% are full time MBA programs, many of which are not ranked and have acceptance rates that are near 100%. That’s very different than the 6-to-12% acceptance rates of the top US MBA programs.

Therefore, findings from the GMAC survey, such as the reported 10.5% fall in foreign nationals applying to all program types, are not predictive for highly-ranked US MBA programs.

Top MBA program demand can be seen through the SBC Survey, which polled MBA program applicants exclusively. Specifically, in order of hierarchy, the SBC survey reports:

98% of US applicants are applying for any US MBA program.

89% of international applicants are applying for any US MBA program.

57% of US and international applicants are applying for US top 10 MBA programs.

46% of US and international applicants are applying to US top 5 MBA programs.

23% of US and international applicants are applying to top EU MBA programs.

10% of US and international applicants are applying to lower ranked international programs.

Lesson: Draw conclusions about MBA program research after evaluating the relevance of the data for your target business programs.

Assumption 2: Decreases in US MBA program applications mean that the value of those MBA programs is diminishing.

False: The decrease in top US MBA program application volumes is actually quite small, and the change is due to the booming US economy. Poets & Quants recently reported that application volumes decreased by under 5% for the US MBA programs of Kellogg (2.7%), Columbia (2.6%), MIT (4.3%), and HBS (4.5%) for the 2017-18 application year.

Given the strength of US economy, these changes are much smaller than we would predict. A strong economy is always inversely correlated with MBA program demand. For example, in the strong economic years between 2002 and 2005, HBS saw a deep decline in applications.

Year-to-year decreases were as high as 18% at that time; 6,559 candidates applied for admissions to HBS in 2005. By contrast, even after the 4.5% dip this past season for HBS, application volumes for the 2017-18 season were 9,886. The explanatory factor is the US economy.

Claims that US MBA value is being undermined by the rhetoric of the Trump administration are not supported. The SBC Survey results echo this reality. A remarkably high 70% of respondents, US and international combined, reported they are not swayed’ by the US political climate and that their MBA plans have not changed. 8% were more likely to apply to US MBA programs.

In addition, among the 22% who reported they were less likely to apply because of the current US climate, 82% of that group is still applying to US MBA programs anyway.

Lesson: Cyclical reasons are temporary. Look past the media headlines and assess what the MBA experience will offer you.

Assumption 3: International MBA programs are pulling international applicants away from the top US MBA programs.

False: International MBA applicants will almost always select a top US MBA program over a lesser-known regional program, if given the choice between admit offers.

The SBC Survey reported that 89% of international MBA applicants are applying to US MBA programs (only or in addition to international programs). Only 11% of the 273 international respondents are not pursuing MBA programs in the US. As well, the majority of the international respondents, at 54%, favor US MBA programs only (not applying to international programs at all).

One reason top US MBA schools are in demand is that top employers continue to source their talent from these pools of students.

“Regardless of political climate, graduates of top US programs have the unique ability to successfully move back and forth between the US and abroad, whereas graduates of even top international programs can find it difficult to recruit into post-MBA positions here in the US,” commented Meghan Ellis, former admissions officer of Wharton Lauder who now works at Stacy Blackman Consulting.

Lesson: Select MBA programs based on career and networking potential, driven by your own preferences around industry, company, and geographic location.

Assumption 4: There will be changes as a result of Trump politics for US MBA programs.

True & False: Some recent media reports speculate that applicants are now avoiding US MBA programs due to the Trump effect; one article claimed that Asian MBA programs are getting the demand that the US MBA programs are losing. SBC’s Survey findings don’t support these claims. The SBC Survey reports a more realistic outlook on adverse impacts.

Reduced recruiting for internationals and fewer internationals at US MBA programs

The SBC Survey respondents predict reduced recruiting for internationals and fewer internationals at US MBA programs as the impacts of the current US political climate under Trump.

Sensitivity to international student representation

The SBC Survey results report the extent to which international student representation matters for MBA applicants. The SBC Survey results show that majority of respondents are content with moderate or any level of international student representation.

If there will be a decrease in international student representation, most MBA applicants will be ok with a shift, but not beyond a reasonable threshold at around 25% international student representation at US MBA programs.

Lesson: Top US MBA schools are committed to creating a class that brings in diverse perspectives from around the world, and competitive MBA candidates are equally as determined to attain an MBA that has lasting value, personally and professionally. Rely on the MBA program brand and reputation as assurance in these changing times.

RECAPTHA :

48

9e

32

a1