Since the financial crisis abated, GE Healthcare has been steadily expanding its reach beyond the westerners that have long served as its clientele. Its sales from the business grew 4.5% throughout 2009-12, reaching $18 billion globally in 2012, as ASEAN – the Association of Southeast Asian Nations – have invested in more hospitals, medical equipment and new technologies.

“We shouldn’t be thinking that growth is the challenge because growth is the given,” says Dave, who oversees some 500 employees across 10 countries. “The question is not how fast you can build; it’s how many fundamentals you have put in place to make it sustainable,” he adds.

GE is one of many healthcare giants that have been capitalizing on emerging countries such as Indonesia and Malaysia’s needs for better health services. The company provides medical imaging systems, diagnostics, patient monitoring systems, drug discovery tools, medical equipment repair services and related IT solutions in this field.

Western companies are plugging a gap and drumming up plenty of new business at the same time. GE's entire business portfolio in ASEAN contributed $3 billion in revenue in 2009.

This rapid growth has thrown the door open for new employment opportunities. There are around 7,000 total employees in ASEAN under the GE banner.

“Having an MBA, especially for a commercial role, will certainly be an advantage,” says Dave, who was appointed president and CEO in 2010. “But… while having an MBA will always be a plus, having an MBA will not guarantee [you a job].”

Increased government spending on healthcare in many Asian countries has accelerated the expansion. The leading US healthcare providers like GE emerged to secure contracts. Even in more established markets like Singapore, expectations are high. The Indonesian government claims the shortage of hospitals is in the region of 1,000, says Dave, and the shortage of healthcare services there is huge.

Born in Jakarta, Indonesia’s capital, he graduated from Texas A&M University in 1990 with a Master's degree in industrial engineering. He joined GE in 1999, within the Silicones business.

In many countries, new healthcare business is being driven by public sector contracts. The World Health Organization predicts that health expenditure per capita in ASEAN has more than doubled since 1998, reaching more than $68 billion.

“Governments committing to healthcare expenditure are helping the market, and definitely at the same time it provides more opportunity for the business to operate,” says Dave, who had a brief stint outside GE with Momentive Performance Materials, where he led their global Ceramics business from Ohio. Prior to that, he was the business leader of Momentive’s ASEAN Silicones business, based in Thailand.

GE has also expanded its physical presence in fast-developing markets. The company established research centres in China and India, and has established several manufacturing plants across Asia-Pacific, the Middle East and Latin America. GE also announced $2 billion of acquisitions during the first quarter of 2014 in Healthcare and Oil & Gas.

The investments have generated strong returns, while the company’s healthcare sales from the developed regions have grown at more moderate rates.

GE Healthcare’s employee headcount in the emerging markets during 2009-12 has also grown at a compound annual growth rate of 15%, while its headcount in most developed markets has either remained flat or declined.

GE Healthcare has also expanded its product portfolio to address the specific pricing challenges of these emerging markets. For example, the company has come up with a super value CT machine specifically for India that costs about one-tenth its premium segment Revolution CT, which costs roughly $3 million a unit.

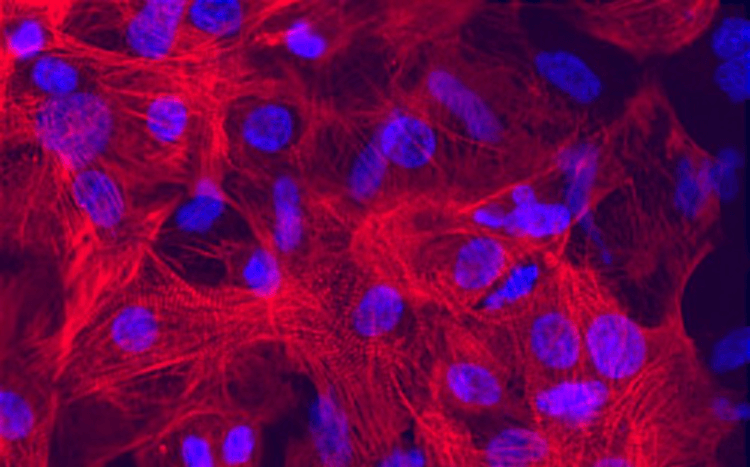

The healthcare market is also being driven by technology. Imaging machines, patient monitoring systems and other tools that offer higher resolution images or more accurate monitoring are preferred by doctors and hospitals. GE has invested in its technology to occupy leadership positions in ultrasound, computed tomography and molecular imaging segments.

“Technology is having a huge impact. The countries we operate in today will require advanced technology for support. It definitely is big for our industry,” says Dave. “When it comes to the disease challenges healthcare is experiencing globally, it does not mean the disease will be less complicated in an emerging market,” he adds.

Overall, diagnostic and clinical equipment technologies generated around $9 billion in sales for GE in 2012. Medical equipment repair, data management and healthcare-related IT services generated another $6 billion, while molecular medicine products which include tools used in drug discovery and agents used in scanning procedures grossed over $3 billion in sales throughout the same year.

Waiting in the wings are business school graduates eager to inject management expertise into these emerging markets. The majority of GE Healthcare’s ASEAN employees come from within the region – but Dave is happy to bring in talent from outside.

“It depends on two things: if a candidate is able to build a career in Asia long-term, and if the talent available… has experience they can transfer,” says Dave.

He adds: “At same time it’s giving the individual experience in working in emerging markets. It’s another thing they will gain when they go back to Europe or the US, for their own leadership development.”

Many of GE Healthcare’s roles in Southeast Asia are based in Singapore. But they are often regional, and involve travelling. “From a base standpoint we would like to see if we can place them where the action is,” says Dave. “We are trying to have more balanced positioning throughout the region, as much as we can.”

Much of the emerging markets’ growth is seen outside of Singapore, however. But new hires will find it easier to adjust to life and work in the country, adds Dave.

He has climbed the corporate ranks within GE and has done seven global moves around the US and Asia, and has held various leadership roles including president & CEO of GE Indonesia.

He says that it is easy to move to different businesses and regions within GE: “We want to bring the current skill-set to the next level. Sometimes it will require movement, and many of us have done rotations within GE… the opportunity will always be there within GE to do the move.”

Rotations are a strong part of the firm’s leadership development. An MBA won’t guarantee you a spot on the bandwagon, however.

“It definitely brings value, but it comes back to the qualification of individuals,” says Dave. “It will never be negative; it will only be a plus.”

RECAPTHA :

6c

be

d4

1b