Every candidate has a different reason for going to business school, but career advancement is one common goal. This might include fast-tracking promotion, launching an international career, or even securing a top salary.

Finance remains a popular career path for master's students, and a Master in Finance (MiF) is a sure fire way to stand out to top employers. It can yield a big return on investment, as well as opening up exciting career opportunities in financial technology (fintech) and sustainable finance too.

But getting a top job in finance isn't easy, and it's important that students identify the right MiF program to help them achieve their ambitions.

Why should you choose a master in finance?

Master in Finance (MiF) degrees remain the most popular master’s degree programs at business schools, according to the Graduate Management Admission Council (GMAC).

Jerome Troiano, director of the Career Center for Master's Programs and BBA at EDHEC Business School in France, believes the MIF is the perfect investment to make for those wanting that good career step in finance. This, combined with choosing a globally recognized school like EDHEC, will help students make that first move into a far more satisfying and coveted position.

“A lot of positions in finance at some point demand a master’s, so it's better to have a masters at the start of your career,” Jerome says.

In terms of helping students to achieve their career ambitions, a MiF is instrumental. At EDHEC, this is the main function of their career center, and is in large part thanks to their tailored, customized approach to students.

“Our students have different backgrounds, different needs, and different objectives,” Jerome says.

First and foremost, because their options are so wide, students need to work out what career path they actually want to take. This is linked to what they are interested and passionate about, or what their different priorities are.

“Once we have helped them find their objectives related to their career, our job is to train them so they can apply effectively and then, once they are selected, they can really ace the interview processes.”

At EDHEC, this includes mandatory group training, as well as one-on-one coaching. The more that students take the initiative with career counselling, the more benefit they will draw from it.

What is the earning potential for Master in Finance graduates?

For those seeking front office jobs in a cutting edge industry, the opportunities in finance are certainly there.

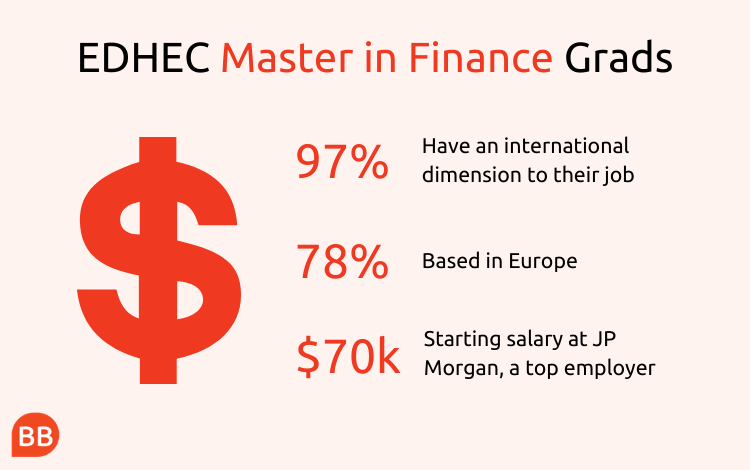

JP Morgan Chase, Black Rock, and Goldman Sachs count among the names where EDHEC MiF graduates have recently found jobs. All are known for being leaders in the financial industries; all known for offering tantalizing salaries. Starting salaries at investment banks like Goldman Sachs and JP Morgan Chase can vary between $70k and even $100k.

EDHEC prides itself on making introductions to these employers early on in the degree. In some cases, students find themselves getting job offers within a matter of weeks of starting the program.

On top of the career coaching they get, the careers center continues to assist even after they get job offers, helping students to negotiate the right roles and salaries that they've targeted.

“If students want to maximise their salary, they can really get the top salaries out there in the market.,” Jerome adds. It's very telling that 98% of EDHEC students are satisfied with their job placement after graduating.

There are dozens of other opportunities in finance beyond conventional positions and areas. Fintech is attracting more attention from MiF graduates, playing to a combination of finance and technology skills that many master’s students embrace, and is an area MiF students should be aware of.

Many students venture beyond financial institutions, finding financial roles within other companies. Public sector jobs are a big pull, such as the European Bank for Reconstruction and Development, with impact investing and sustainable finance also growing areas of interest.

This versatility is one of the biggest appeals of a MiF degree, Jerome believes. “You can apply these skills in almost any industry across a wide range of positions. You’re able to have both international mobility and to move from one sector to another. When you think about it, there are few functions that can allow this.”

How can you prepare for a career in finance?

A MiF’s chief aim is to prepare students for their career of choice, equipping them with the necessary skills for success in financial and other sectors.

Jerome has seven years of experience working in corporate finance, including stints at Barclays Capital and Bloomberg Private Equity Fund. He has a clear idea of what it takes for students to progress their careers.

First, reliability. “For almost all jobs in finance, the stakes are high, so your manager and the clients need to be able to trust you, so ethics is essential for applicants in finance jobs.”

Secondly, working under pressure. “Often the processes are very tight, you need to be very proactive, and be able to deal well with pressure.”

Finally, teamwork. It’s not simply a survival of the fittest. “You need to be able to collaborate, because you’ll be dealing with clients and teams from all over the world, and it's always a team effort. If you are too focused on your own career and objectives, at some point, you’re going to fail.”