Walking through Shanghai’s central business district and you’re dwarfed by giant digital billboards advertising fashion brands. Meanwhile, along the Bund at night, skyscrapers and stocky colonial buildings alike are emblazoned with illuminated lights and advertising slogans. China is a country that seamlessly blends its rich history with cutting-edge modernity.

Despite this, you’ll struggle to navigate your way through China without a smartphone nowadays as transactions become increasingly cashless and payment apps such as WeChat Pay and Alipay proliferate. In 2022, almost 72% of Chinese people used a smartphone—a number that’s expected to reach 83% in 2027.

The widespread use of smartphones in the country—combined with a proclivity for tech—is one of the many reasons why China has become a world leader in the e-commerce market.

To find out what’s behind the growth in e-commerce in China, BusinessBecause spoke to Professor Majid Ghorbani, an associate professor of practice in Strategy and Entrepreneurship at China Europe International Business School (CEIBS).

The role of livestream shopping

At companies such as Buy Quickly in Shanghai, there are entire buildings dedicated to livestream shopping. These buildings house influencer ‘factories’ where KOLs (key opinion leaders)–China’s term for influencers–present products from well-known brands ranging from the likes of Under Armour and Adidas, to luxury brands such as Montblanc, all in real-time.

The livestream shopping is usually hosted on platforms such as Douyin (China’s version of TikTok), Taobao, and Alibaba.

Some businesses even offer training schemes to aspiring influencers, as well as hair and makeup facilities, and subsidized accommodation close to the livestreaming factory.

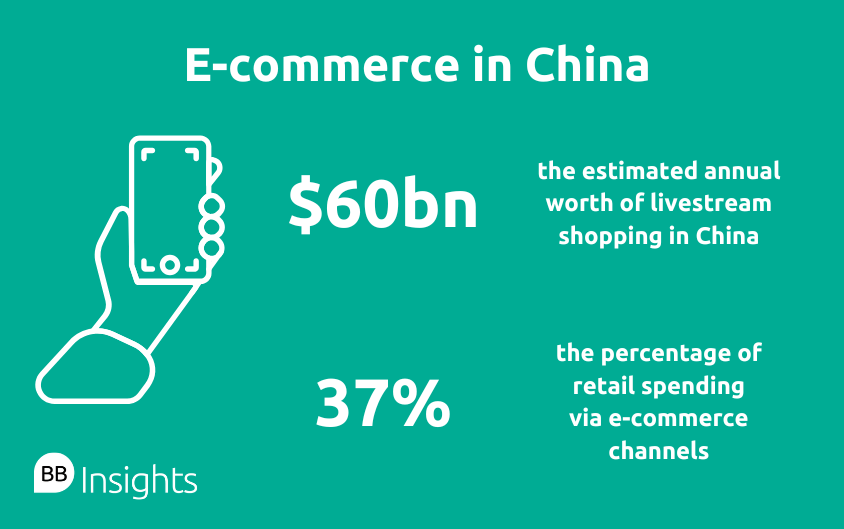

Livestream shopping in China is estimated to be worth a cool $60 billion annually, unsurprising as 37% of retail spending in the country is via e-commerce platforms.

In China, an impressive 57% of consumers engage with live commerce, whereas in regions such as Europe, Latin America, and the United States, only about 5-7% of users utilize live streaming for shopping inspiration—according to McKinsey & Company. Professor Majid notes that one of the possible reasons China is best placed for livestream shopping is because internet access is far cheaper in China compared to the US.

“This becomes extra important for livestreaming, which uses a massive amount of data compared to generic e-commerce,” he says.

“Mobile shopping and payment [also] have a longer history and higher penetration rate in China vs the US. These created a favorable environment for a paradigm shift to livestreaming and shopping through this new medium.”

Images taken by BB/Shannon Cook at Buy Quickly in Shanghai

The rise of social media in China

China has the largest social media audience globally, but instead of Facebook, Instagram, and X (formerly Twitter), China has its own suite of sophisticated social media platforms, such as Douyin, Little Red Book, and WeChat, which are used by one billion users across China.

“As is the case with TikTok, most social media also use better and more accurate algorithms and AI to recognize what users would prefer to watch or how to line up a series of feeds,” says Professor Majid.

KOLs also play a key role in China, with the professor noting that Chinese consumers, similarly to those in many other eastern cultures, are more likely to follow celebrities and KOLs.

“The Chinese are more prone to build up recognition and followership of influencers more rapidly than in many other countries", he says.

Viya and Lipstick King are heralded as the top KOLs in the livestream world, with the latter renowned for driving more than $145 million in sales on Singles’ Day—a shopping day similar to Black Friday in the US.

Digital payment solutions and mobile banking: A must in China

Heading to China without any form of digital payment solutions is like going on a road trip without a GPS. You’ll be able to find your way eventually since many places still accept cash, but it’ll make your life a whole lot easier to pay digitally.

Professor Majid believes the adoption of digital payment solutions in China has played a large role in the success of the e-commerce market.

“From their inception, they did not have a set up cost, and transactions between individuals or businesses bear no charge.

“Due to their convenience and the lack of alternatives (such as credit cards or even debit cards), digital payments were picked up very rapidly across China and by individuals, shoppers, and merchants alike.”

Familiarization with the instant exchange of money by simply clicking a button or scanning a QR code may explain why Chinese consumers are more likely than their western counterparts to purchase products from e-commerce markets in real-time.

E-commerce in China is also based on online payments that don’t rely on an individual’s credit, such as the credit card system.

“Even though these days it is possible to link a credit card to one’s online payment wallet (such as Alipay or WeChat-pay), the majority of online payments in China are linked to one’s bank account or credit initially transferred into the online wallet,” explains Professor Majid.

He adds that most online shopping platforms use different transaction processes that are more consumer friendly than primarily merchant protecting methods deployed in the US.

“Platforms essentially hold on to the payment from the buyer and only release it to the merchant after the former confirms the correct product or service was received.

“The combination of these fixed the trust issue for Chinese consumers, while they remained an issue in the US,” says the professor.

Government intervention in e-commerce in China

China’s growth in the e-commerce sector has been further bolstered by supportive government policies.

“The government allowed digital platforms and particularly payment methods to grow with minimum to no restrictions. These may be because the government realized that e-commerce growth fueled the wheels of economic development in many parts of China and contributed greatly to China’s GDP,” says Professor Majid.

In some regions of China, the government has even partnered with e-commerce platforms, such as Alibaba, helping them to establish in remote rural areas to help locals integrate into the national economy by selling their products and buying out-of-reach products.

“This growth and connectivity [has] helped suppliers and the network of the supply chain to reach economies of scale and become more competitive globally.

“[It has] also motivated companies to build more efficient and sophisticated logistics networks.”

MBA careers in e-commerce

With the booming e-commerce sector in China comes career opportunities for future business professionals.

“MBA graduates must think about learning about e-commerce if they want to work or live in these markets,” says Professor Majid.

Top business schools, such as CEIBS, allow MBA students to learn about different aspects of e-commerce in China. These are included as special sections of core courses in marketing, strategic management, and finance and particular electives that teach MBA students about entrepreneurship, business models, platform strategy, and digital transformation for the purpose of e-commerce.

The dynamic atmosphere of an e-commerce market is tricky to put on paper, which is why schools such as CEIBS offer field trips to major e-commerce players such as Buy Quickly.

Some CEIBS MBA alumni have even gone on to land leadership roles in e-commerce, including the vice-president of Buy Quickly.

“Anyone working in China or preparing to start a business in China and most other East or Southeast Asian countries must be familiar with online and offline channels of communication, marketing, and e-commerce,” concludes Professor Majid.