A unicorn company is a privately held startup with a billion-dollar valuation or more. The term was coined by prominent seed-investor, Aileen Lee, when she wrote about billion-dollar tech startups in the early 2000s.

Google and Facebook were among the first startup unicorns. Founded in the 1990s and early 2000s, respectively, they quickly shot to billion-dollar valuations, at a time when just 0.07% of software startups reached this status.

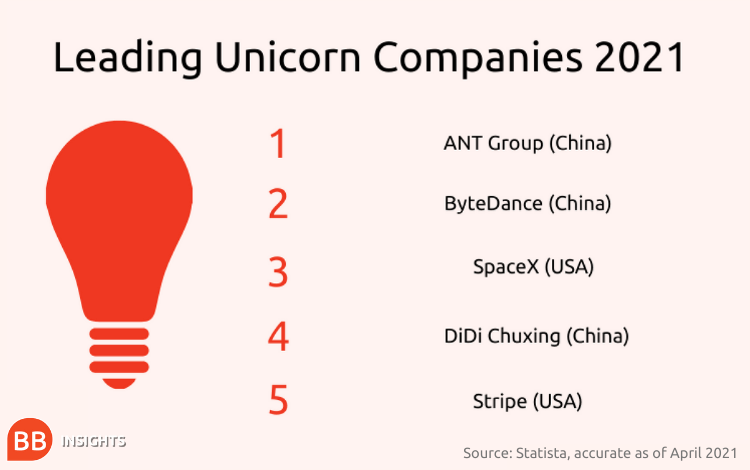

Since then, the number of unicorn startups has ballooned. As of 2020, there were more than 600. But does a billion-dollar valuation guarantee success?

Why should you be sceptical of the most valuable startups?

When a startup is being valued, investors estimate the value of the business based on projected growth and potential, rather than actual profit and revenue. For this reason, it only takes a handful of optimistic investors for the valuation of a startup to skyrocket.

These large valuations tend to give new investors confidence in the company, allowing it to attract attention and either scale up quickly, or be acquired by a larger organization.

However, these high valuations are far from a guarantee of success.

“These huge valuations are likely to be a very rough estimate, as unicorns are often focused on entirely new markets, technologies, or business models,” explains James Hayton (pictured right), a professor in innovation and organizational creativity at Warwick Business School in the UK. “Very high valuations are associated with equally high levels of risk.”

Another reason to be sceptical of the valuation of unicorns is that these figures are usually based on the success of similar companies. In theory, this comparison considers whether there’s a market for a startup’s products or services.

But these comparisons can draw false equivalencies. They don’t take into account whether the startup is losing money and can lead to hugely inflated valuations that deceive investors.

“People buy into these companies because they look good, and they will overpay because someone else will pay more,” explains Luisa Alemany, associate professor of management practice at London Business School.

A rash billion-dollar valuation can lead to a lower than anticipated return for investors, she adds.

The agreements that investors have with a startup can also secretly lower its actual value. Before an IPO, companies are not required to disclose the rights that investors have to shares, dividends, and cash flow.

“A couple of professors at Stanford and British Columbia have looked at this,” Luisa explains. “They found that unicorns are valued at 50% more than their actual valuation when you account for cash flow rights.”

The domino effect of investing

When a startup’s valuation shoots toward unicorn status, it can also increase pressure among would-be investors to get involved before it takes off.

“People will be saying ‘oh look, they’re going to be a unicorn,’ and so they will all try and get in before the company’s IPO,” comments Luisa (pictured right).

Despite the investment rushing into the company, this pressure can actually do a startup more harm than good, thinks James of Warwick Business School.

“This investment puts pressure on founders to spend big—hiring more talent, opening offices, or expanding rapidly around the world to capture the market,” he says.

“Those investments increase the burn rate of capital, ensuring that costs far outstrip revenues.” As a result, James explains, the new unicorn is exposed to more risk.

Startup unicorns can lead to more innovation

Despite these risks, the excitement and optimism that the valuation of unicorns creates can have a positive impact on the startup and innovation ecosystem.

Often, early employees leave startup unicorns to pursue projects of their own—the high valuation and quick growth they were exposed to may be an important factor in building the abilities and confidence required to be an entrepreneur.

One prominent example of this trend is the so-called ‘PayPal Mafia.’ Founders and early employees of the fintech giant have gone on to found some of the most successful tech companies of the last decade. PayPal’s anti-fraud developer, Jawed Karim, is a co-founder of YouTube, while the former PayPal engineer, Jeremy Stoppelman, went on to co-found Yelp.

When discerning the success of these companies, billion-dollar startup valuations should be approached with caution. Of course, there are startup unicorns that are hugely successful, but valuations are often based on potential and guesswork more than concrete analysis. That can put a lot of pressure on both founders and investors to grow rapidly and take on risks.

Despite these downsides, unicorn valuations don’t seem to be going anywhere, and the number of startup unicorns is growing. The buzz that can generate in the business world can help entrepreneurs launch game-changing companies, which can only be a good thing for the future of innovation.

Read Next:

How Remote Coaching Is Driving Growth For Entrepreneurs In Emerging Markets

BB Insights explores the latest research and trends from the business school classroom, drawing on the expertise of world-leading professors to inspire and inform current and future leaders